Over the course of the entire year 2016, WBA Aachener Werkzeugbau Akademie, Germany presents spotlights of the most important international tool and mould markets. This edition focuses on China, the world’s largest and most complex tooling market.

The economy and the industry

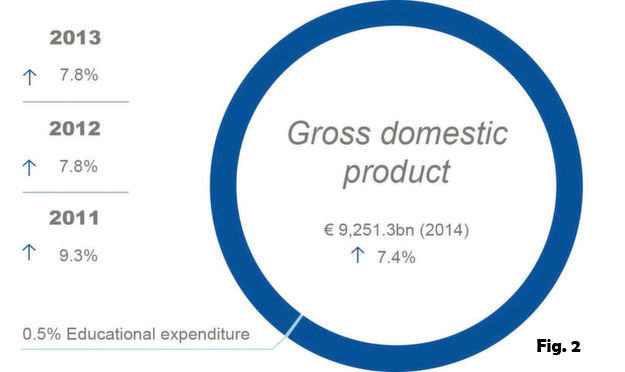

In terms of the Gross Domestic Product (GDP), China is the second largest economy in the world, second to the United States of America (Fig. 2). The GDP per capita is approximately €6,764 and thus within the lowermost third of the countries, which were compared in the present study. The economy has grown by an average of 8.1% in the last four years. Since 2000, China’s economy grew by more than €1bn. In 2009, China for the first time took over from Germany as the largest exporting nation in the world.

China is currently the world’s largest exporting and second largest importing nation. Nearly 10% of all global exports and imports are directly linked to China. The country’s exported goods are worth €1.86bn in 2014, mainly originating in electronic, textile and machinery sectors. The country has various natural resources, such as tungsten, coal, iron ore, graphite, tin, platinum and petroleum.

Nevertheless, primary materials are the second largest import goods. More than 50% of the total GDP is generated at the east coast of China. In 2013, the wage level was on average €6,549 and thus significantly lower than all industrial nations, while the income per capita in urban areas is twice as high as in rural areas.

On average, every employee works 2,288 hours per year, which is more than in any other country considered in this study. Labor productivity has risen proportionally to the labour costs in recent years. However, this average is particularly supported by the increase of productivity in agriculture. Particularly in the industrial sector, labour costs have increased for several years faster than productivity.

China's tool and die industry

According to official statistics, China’s tool and die industry comprises of more than 40,000 enterprises with overall more than 1m employees. Compared to Germany, China has a significantly larger number of tool and die manufacturers with more than 100 employees.

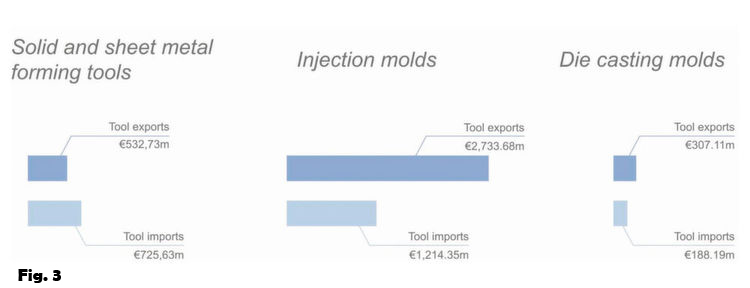

In 2012, China produced tools and dies worth €15,720.87m. Since 2010, this value increased from €11,999.30m. In 2013 (Fig. 3), 301,644 tons of tools and dies with a value of €3,573.53m were exported. The number consists of solid and sheet metal forming tools worth €532.73m, injections moulds worth €2,733.68m and die-casting moulds worth €307.11m. In the same year, China imported tools worth €2,128.16m which comprised of €725.63m of solid and sheet metal forming tools, €1,214.35m of injection moulds and €188.19m of die casting moulds.

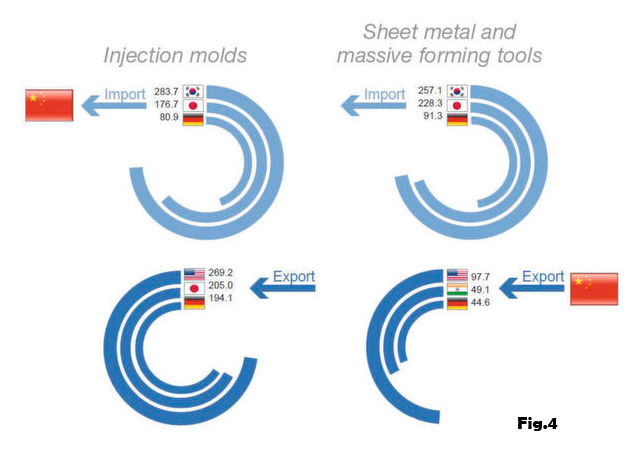

The Chinese trade of tools with foreign markets is illustrated in Fig. 4. The largest trade partners for importing injection moulds are South Korea, Japan and Germany. Injection moulds are mostly exported to the USA, Japan and Germany. The largest trade partners for importing sheet metal and massive forming tools are South Korea, Japan and Germany, while they are exported mainly to the USA, India and Germany.

The rise of the tool and die industry and the rise of the Chinese economy occurred simultaneously. The sales development of the tool and die industry was in line with the development of the economy as a whole. Barring the years of crisis, 2008 and 2009, the tooling industry grew in double-digits thanks to massive governmental aids within a 5-year plan. The tool and die industry is present all over the Chinese mainland. In the East Chinese coast, the tool and die industry has developed into a core industry. The coast provinces of Guangdong, Zhejiang, Jiangsu and the city Shanghai collectively cover 80% of the total tool and die production.

Internationally competitive companies likely to evolve

Chinese tool and die manufacturers distinguish themselves by a very high availability of manpower and resources, which enables them to accomplish low lead times – comparable with Germany. Though, in most cases the engineering expertise for sophisticated tools and dies is absent in both the assembly as well as the qualification of tools and dies. In the meantime, there are several enterprises related to all tool and die types, which operate on highest international level along the overall process chain in tool and die manufacturing. Solely because of the size of the industry, China will have a key role in the world of tooling in future.

The fact that internationally competitive companies with a high level of competence could evolve confirms the positive outlook for the development of the tool and die manufacturing industry in China.

(According to etmm-online.com)