Robust Demand Forecast for Automotive Toolmakers

Automotive tooling spend will rise to $2.7 billion in Q2 of next year, according to Harbour Results. Starting in 2024, four “glory years” of growth will send that figure soaring to $8.6 billion.

The next decade is being forecast as generally favorable for suppliers of automotive tooling, according to Harbour Results Inc. (HRI) of Southfield, MI.

As manufacturing generally, and the automotive industry in particular, have weathered the COVID-19 pandemic better than initial expectations, “that’s helping the toolmakers quite a bit,” said Laurie Harbour, President and CEO of HRI. The company shared findings from its “2021 Automotive Tooling Outlook” report in an Oct. 19 webinar.

The performance of manufacturing overall “is really quite good,” Harbour said. “There are a lot of very positive things (happening) across all industries. . . . Durable goods demand is very strong, driving not only new volume but new programs, so lots of new models . . . not just in automotive, but in all kinds of industries. And we really expect that to continue for quite some time.”

This all means “a pretty strong tooling demand forecast for our toolmakers,” Harbour explained. In surveying toolmakers, HRI found that 76% are going into 2022 with a generally optimistic view — neither expecting a continued boom nor a big bust. With backlogs of three months at small to medium shops and five to six months at larger facilities, toolmakers are expecting about 10% revenue growth going into next year; 90% of shops are projecting more than 3% growth in earnings before interest and taxes at end of this year.

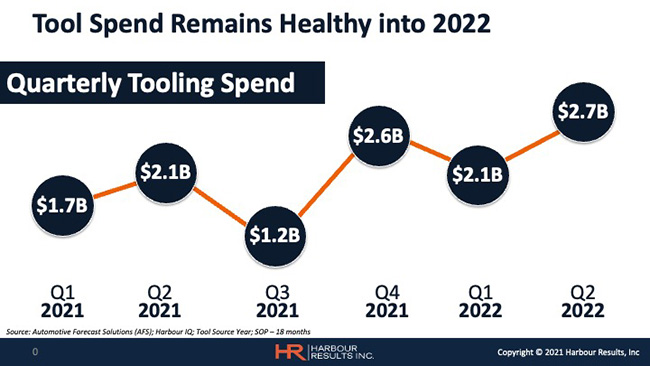

Make no mistake: “Doing business as a tool shop in today’s environment . . . is harder than ever before,” Harbour acknowledged. That said, quarterly demand for automotive toolmakers has remained strong through 2021, with a third-quarter dip to $1.2 billion in tooling spend as OEMs introduced new products. Harbour expects automotive tooling spending to jump back up to $2.6 billion in Q4 of this year and rise to $2.7 billion in Q2 next year.

Longer term, in 2024 she expects automotive tooling spend to grow to $8.6 billion on the strength of launches of new BEVs and pickup trucks. Those launches will fuel four “glory years” of growth through 2027, followed by a dip in 2028 and a reset of the tooling-and-launch cycle through to 2030 as model lines are refreshed.

Despite semiconductor and supply-chain shortages, the Big 3 Detroit carmakers are recording “unprecedented” profitability, said HRI Business Analysis Manager Matt Trentacosta. While the average supply of new cars across the industry has dropped 46%, to 35 days of inventory from 65 days on average in 2019, the types of vehicles being sold have buoyed automaker profits.

Right now, Harbour concluded, “this decade, the balance of it . . . looks to be a very, very strong decade for the tool industry.”

Due to the COVID-19 epidemic, in the past two years, the mold orders fell, but Bluestar is still confident in the automotive tooling market and we are still working hard and keep continuous improving to keep up with the constant changes in the market and determined to build better brand which is “Bluestar Automotive · Global Service”.

News Origin:plastic today

Ps: Harbour Results, Inc. (HRI) offers operational and strategic advisory expertise and proprietary assessment programs to equip companies for the economic and customer obstacles that cannot be predicted. As the trusted advisor to the manufacturing industry, it is our goal to enable growth, execute change and resolve issues affecting short-term sustainability, near-term viability and long-term success for small- to medium-sized manufacturers.